Derivatives Managed Account Program

Sapphire TradeX offers FX and CFD managed accounts for retail investors, who have neither the time nor expertise to manage their own accounts.

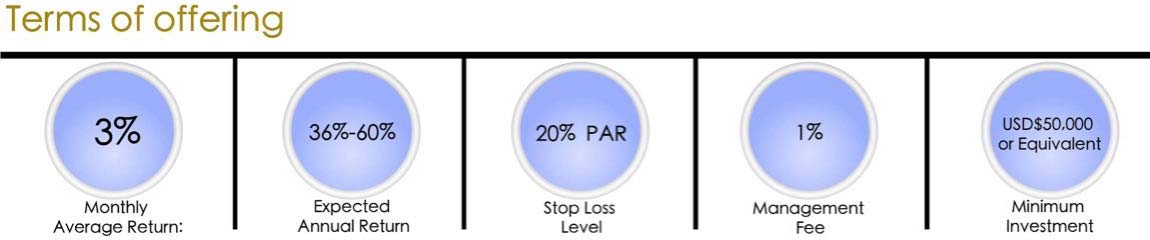

Terms Of Offering

- Minimum Investment:

- US$ 50,000 USD or equivalent

- Management Fee:

- 1 %

- Performance Fee:

- 20 %

- Average Monthly Returns:

- 3 %

- Attempted Annual Return:

- 36 % ~ 60 %

24/7 Customer Service

Instant access to your money

Accounts held at brokerage banks

Notes: Past Performance Is Not Indicative of Future Results

Managed Accounts Program Enrollment Procedure

- Apply by sending us your personal data to our email: contactus@sapphiretradex.com. Personal data include your full name, identification number, nationality, contact number, email address and the amount of trading capital you intend to invest.

- Open a trading account with our stratgeic brokers.

- Once your trading account is opened you have to deposit your money into the account.

- When your account is opened, please send us signed Limited Power of Attorney (LPOA) to our email: contactus@sapphiretradex.com

- Once we receive the LPOA, we resend it to our broker who will automatically put your trading account under our management.

- As soon as the broker receives your LPOA together with all documents needed for opening the account and your money is deposited in your account, we will start trading your account.

Past Monthly Returns

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2014 | 3.16% | 2.13% | 4.31% | 2.69% | 1.35% | 3.48% | ||||||

| 2015 | 3.87% | 5.21% | 3.84% | 4.21% | 2.16% | 5.01% | -0.22% | 1.31% | 4.44% | -0.29% | 5.34% | 2.08% |

| 2016 | 3.78% | -0.02% | -0.67% | 4.27% | 5.36% | -0.48% | 6.61% | 4.35% | 5.31% | 4.61% | 2.82% | 3.74% |

| 2017 | -1.38% | 4.75% | 5.21% | 3.86% | 3.24% | -0.73% | 5.54% | 6.34% | 3.55% | 3.23% | 3.10% | 6.00% |

| 2018 | 1.58% | -1.69% | 1.13% |